As a church leader, one big question you might have is: should you pursue 501c3 church non-profit status? It’s something we all have to look into and consider as pastors and church leaders.

It’s important to weigh out both the pros and cons before making any decisions. And if you decide to go for it, don’t be intimidated—getting 501c3 status isn’t as complicated as it may seem!

In this blog post, we’ll dive into what earning nonprofit status can do for your church and how you can go about getting it. So get ready for an informative guide.

Please note: you should consult with a certified tax professional or the IRS Tax Exempt & Government Entities Division. to confirm all details of your 501 c 3 tax exemption and to ensure you’re compliant with the tax code. This post is not official financial advice or legal advice.

Estimated reading time: 10 minutes

Table of contents

- What is 501c3 Status and What Does it Mean For Your Church?

- Approval for 501 c 3 tax-exempt status

- Aren’t Churches Already Tax Exempt?

- What are the benefits of 501 c 3 church status?

- What are the drawbacks of a church having 501 c 3 status?

- How can your church get 501 c 3 status?

- How Do You Know if 501c3 Status is Right for Your Church?

- Summing it Up

- Read more

What is 501c3 Status and What Does it Mean For Your Church?

Did you know that ‘501c3’ is an IRS tax code? And this part of the IRS code is an important one too because it refers to a type of nonprofit organization that is exempt from federal income tax.

501(c)(3) nonprofit status is a designation for charitable organizations in the United States. Therefore, a nonprofit organization cannot be operated for the benefit of private interests.

Approval for 501 c 3 tax-exempt status

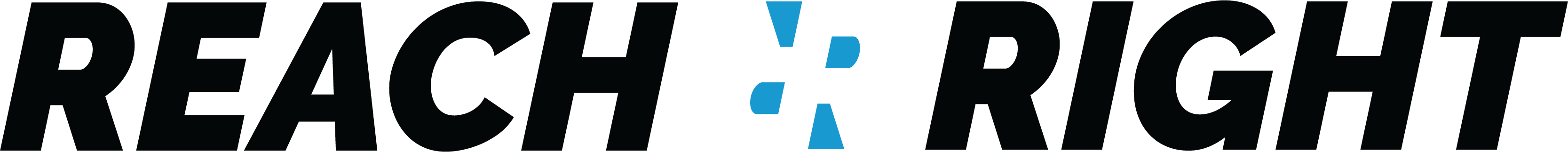

To be approved for 501 c 3 status, an organization must meet certain criteria which include:

- having a charitable purpose

- being organized and operated exclusively for religious, educational, scientific or other specified purposes

- none of its earnings may inure to any private shareholder or individual (meaning net earnings can’t go to a person)

- not attempting to influence legislation

So, receiving 501 c 3 tax-exempt status exempts the organization from paying federal income taxes and can help them secure funding through grants or donations.

Organizations (not just churches) must apply for 501 c 3 status and meet certain requirements to receive the tax exemption.

In addition, if granted, they are eligible to receive charitable donations from individuals and other organizations and can even benefit from grants, tax deduction, special government programs, and additional tax exemptions.

The IRS recognizes that 501 c 3 status means that a church is exempt under the tax code. This means that the church does not have to pay federal taxes on any of its income and also can receive tax-deductible contributions from its members and the public.

To sum it up, to receive 501c3 status, a church must meet certain requirements, such as being not for profit and having a charitable purpose.

Aren’t Churches Already Tax Exempt?

One common question that’s asked is whether churches should even bother applying for 501 c 3 status…because aren’t religious organizations automatically considered tax exempt?

In fact, most churches, synagogues, mosques, etc are already considered tax-exempt.

Who the IRS already considers tax-exempt

Publication 557 lays out the rules and procedures for established nonprofits and others seeking nonprofit status under the Internal Revenue Code.

This IRS publication clearly states:

“a church, its integrated auxiliaries, or a convention or association of churches isn’t required to file Form 1023 to be exempt from federal income tax or to receive tax-deductible contributions.”

The IRS has two basic guidelines for determining if an organization meets the religious purpose test:

- That the organization’s religious beliefs are truly and sincerely held

- That the organization’s practice and rituals aren’t illegal or contrary to defined public policy

Some additional information is spelled out for conventions or association of churches, integrated auxiliaries, and special rules for seminaries, etc.

This means that some churches are already covered by their denomination or convention. (Check with your church officials if this might apply to you.)

Although the IRS doesn’t have a single definition for “church,” if a religious organization meets the criteria listed above, then the organization is exempt from federal income tax and eligible to receive tax-deductible contributions.

However, the report goes on to say that churches and religious organizations may still find it advantageous to obtain recognition of exemption.

So, since most churches are already tax-exempt they don’t necessarily need to apply for 501 c 3 status. However, several key benefits can come from achieving this recognized status.

What are the benefits of 501 c 3 church status?

There are a few really great benefits to earning nonprofit status. Probably the most obvious one is that it opens up doors in terms of funding and cost savings.

Applying for funding

Nonprofit organizations can apply for grants and funding from a variety of different sources. This could help a new church get their mission off the ground.

You can also explore benefits like being eligible for nonprofit mail through the US postal service.

Building credibility

Additionally, earning nonprofit status can also help organizations to build credibility and trust with their donors and supporters.

People may be more likely to donate money or time to a church that has been officially recognized by the US government as having official 501 c 3 status. This adds a sense of security and oversight.

Reducing taxes

Finally, having an official 501 c 3 nonprofit status with the federal government may help organizations reduce their taxes, which can be a big help when it comes to keeping expenses down.

A nonprofit corporation still has to pay employee taxes like social security and Medicare. But they are exempt from sales tax and property tax.

Depending on where you live, there may be benefits when it comes to state sales tax or receiving discounted rates on certain services.

What are the drawbacks of a church having 501 c 3 status?

Although many churches opt for tax-exempt status as a 501 c 3, there are potential drawbacks that should be considered before making the decision.

Restricted political involvement

501 c 3 organizations must abide by certain rules regarding political activities. This means that churches cannot engage in any type of lobbying or political campaigns in support of an individual, party, or candidate.

While some prefer to avoid political discussions in their church services and keep a strong separation between church and state, others want the freedom to openly speak about politics and government.

While churches can speak out on political issues, they are not allowed to endorse or oppose any specific candidates. This limitation can be a hindrance for churches that want to get involved in the political process and advocate for their beliefs.

Public disclosure of finances

Because 501 c 3’s are subject to certain regulations, churches must make their finances publicly available. So this means that any donations received or expenses incurred by the church must be reported to the IRS and made available to the public upon request.

501 c 3 churches are subject to more government oversight than other organizations. In addition, this means that the IRS can audit them more frequently and ask for more information about their activities. This added level of scrutiny can be a burden for churches and can hamper their ability to operate freely.

Loss of autonomy

Finally, churches may also fear that they lose some of their autonomy as a result of becoming a 501 c 3. This is because there are certain rules that must be followed in order for the church to maintain its status. Violations can result in of the exemption.

On a similar note, churches fear restrictions or infringements on their right to free speech. They also worry about compromise in holding to their beliefs if the government has too much oversight of internal affairs.

Overall, it is important for churches to carefully consider all of the pros and cons.

How can your church get 501 c 3 status?

Anyone serious about obtaining 501 c 3 status has to determine which of the three types of nonprofit organizations they fall into: religious, charitable, or educational.

Once you have determined this, you can file for tax-exempt status as a 501c3 church.

How to file for exempt status as a 501 c 3

Here are the steps you need to take and the questions you’ll need to answer. This process is for churches who seek official nonprofit status under Internal Revenue Code section 501(c)(3)

- Is your church organized as a trust, corporation, or association?

- Does your organization have a tax-exempt purpose? See Types of Tax Exempt organizations.

- Do you have an Employee Identification Number? You can apply online for an EIN.

- Complete IRS Form 1023 or 1023 EZ

- Complete the determination letter and submit the required filing fee. This can be found as IRS Form 8718 User Fee for Exempt Organization Determination Letter Request

- You can also complete Form 1023 and pay user fees online at www.pay.gov.

How Do You Know if 501c3 Status is Right for Your Church?

For churches and religious organizations, let’s sum up the considerations of becoming an official 501 c 3.

- 501(c)(3) is a tax-exempt designation that is given to certain organizations by the IRS. To be eligible, your church must be organized and operated exclusively for religious purposes. This means that your church cannot engage in any activities that are not related to religion, or they could lose 501 c 3 eligibility.

- Some of the benefits of 501c3 status include exemption from federal income taxes and eligibility to receive tax-deductible contributions from individuals and businesses.

- In order to qualify for 501c3 status, your church will need to complete an application with the IRS and file annual returns.

There are a few things to keep in mind when deciding whether or not to apply for 501c3 status.

First, it’s important to make sure that your church meets the eligibility requirements.

Second, there are some administrative tasks involved in maintaining 501c3 status. These include filing annual returns and keeping track of donations.

Finally, there may be some restrictions on how your church can use its tax-exempt status.

If you’re unsure whether or not 501c3 status is right for your church, consult with a law firm or accountant who specializes in nonprofit law.

Summing it Up

Obtaining 501c3 status can be a great way for churches to take advantage of tax exemptions and receive donations. However, it’s important to make sure that your church meets the eligibility requirements and is prepared to handle the administrative tasks involved in maintaining its status.

Ultimately, seeking professional advice will help you determine if 501c3 status is right for your church. We recommend you talk to your accountant, tax advisor, or legal professional.