The budgeting process is not one that most people enjoy. But it is vital to a church’s mission and success. God tells us to be good stewards of our money and to honor the Lord in Proverbs 3:9-10, “Honor the Lord with your wealth, with the first fruits of all your crops; then your barns will be filled to overflowing, and your vats will brim over with new wine.”

Church leaders, it’s up to you to determine a church’s budget. Of course, this doesn’t mean it’s all on you, nor should it be. Following a few tips, you can hopefully create a church budget to get you out of debt, see growth, and feel secure.

We hope we can help you to create a church budget that is simple and easy to follow for many years to come!

Table of contents

Estimated reading time: 12 minutes

Does your church need a budget?

If you don’t use any formal system to manage your finances at home, you might be tempted to think you can manage your church’s finances without a budget. Depending on your church’s situation, you might be able to get by without one, but not for long.

It is defintely a commitment to plan ahead, to carefully think through significant financial decisions, and to stop guessing how choices will impact your church’s bottom line. If you want to maximize your resources and do everything you can to grow, then a budget is a necessity. This is where you plot out how you will use your resources to fulfill your church .

This is why having a budget is so important:

1. Church income fluctuates

Most churches will see major spikes in attendance and giving around Christmas, Easter, and Mother’s Day, as well as other times of the year like the back-to-school season. Most churches also see dramatic drops in attendance during the summer months as members go on vacation.

Even if all of your members have signed up for monthly giving, your church’s income is naturally going to fluctuate throughout the year as visitors come and go. If you don’t plan for those changes, your church’s financial situation may constantly feel unreliable, where you make choices based on whatever happens to be in your accounts each month.

A budget helps you prepare for seasonal trends, making it easier to create a buffer against future slumps. It can also help you plan for months where your expenditures may be higher (such as Christmas or an annual conference).

2. Church expenses can get out of control fast

As churches grow, the number of people with access to the church’s finances grows too. You might have several ministries that each need to make purchases independently, and multiple staff people with the authority to buy things on behalf of your church.

A budget ensures that everyone is on the same page about how much money can go toward which areas and what kinds of purchases. It also reduces the burden on any one person to be the arbiter of your church’s finances. Once a budget is in place, then people know from the beginning what is possible and what is not.

3. Budgets hold you accountable

It’s easy to make exceptions, let things slide, and justify unnecessary expenses. A budget is something you carefully plan and agree on as a team before you find yourself in situations where you might spend more than you mean to. Again, it reduces the burden of particular people to “make the call” on every purchase, because everyone will be more aligned on the big picture.

Budgets also give you a clear benchmark when you review your financial decisions each month. It’s a lot harder for your staff to hold themselves accountable if there is no defined amount they are supposed to spend, and no context for how everything fits into your church’s finances.

Church Budget Types

Church budgeting is very different from home or personal budgeting. Budgeting for a church is closer to budgeting for a business since you’re responsible for the money of hundreds or possibly even thousands of people.

Here are three common church budget types you can use:

Line Item Budgeting

Also known as incremental budgeting, this is one of the most common budgeting approaches for businesses and churches. This budgeting approach is best used if you already have an established budget – you simply take the items from past years and tweak them in anticipation of the upcoming year.

Zero-Based Budgeting

In zero-based budgeting, you start with a zero-dollar balance every year. That also means you can’t have any debt left over from the previous year.

This might not be feasible every year because your church may have emergency needs. However, it’s still a good idea to use zero-based budgeting every few years to “reset” your finances.

Program-Based Budgeting

Another form of budgeting is program-based budgeting. You can consider budgeting church finances based on the programs you run. This kind of budgeting gives you extra control over which programs get more funding to achieve their goals. You can also spot the programs that may need extra income streams or fundraisers to fund their operations.

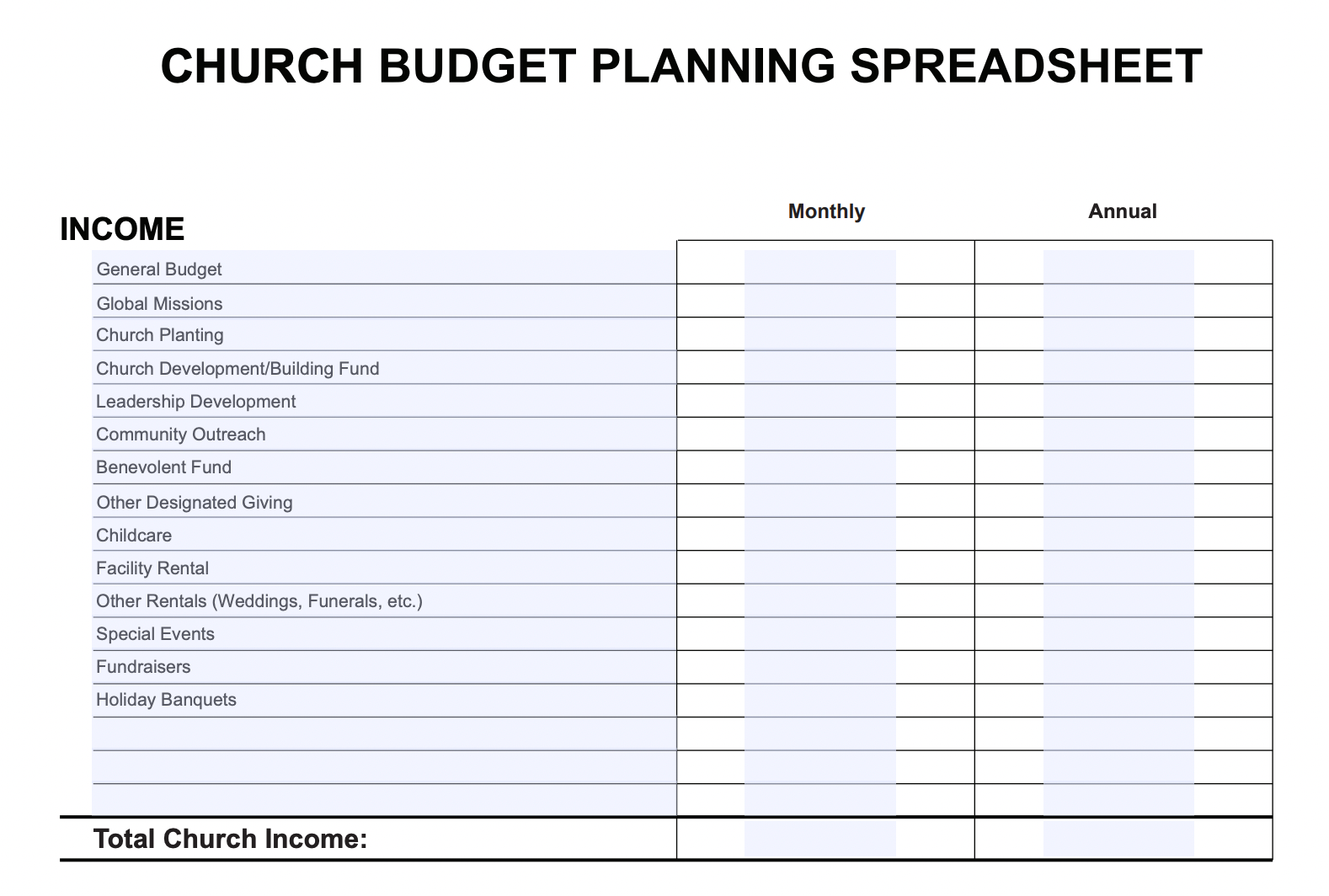

Content of a Church Budget

- Income streams: This budget item includes all ways your church can receive money. Common income streams are donations, fundraisers, and online or text-based giving. Consider keeping income streams separate if they’re used for specific programs.

- Personnel expenses: This budget item includes staff salaries and benefits like healthcare or insurance. You can also include recruitment costs here.

- Administration and operational costs: Administration costs are usually consistent from year to year. These expenses include building rent and office equipment expenses.

- Facilities and equipment maintenance: Maintenance costs usually stay the same, much like administration costs. These fees include janitorial expenses and audio equipment repairs.

- Direct ministry program expenses: This is usually your church’s primary program. It should cover all costs incurred by your children, youth, and adult ministry initiatives.

- Outreach costs: This budget item covers social events, mission trips, and other evangelism efforts.

- Church growth fund: This item stores the funds your church needs to grow. Even if you can’t expand your church in the coming year, it’s a good idea to save up for it.

- Reserve funds: This is a budget item that holds your emergency funds. Your church should ideally have three months’ worth of reserves to keep running in case your income streams dry up.

- Debt repayments: Debt can include anything from mortgages to loans for large expenses.

- Software costs: Churches may need church management software like Breeze to help manage their day-to-day operations. This means they need to put the cost of implementation into their budget.

Church Budget Templates

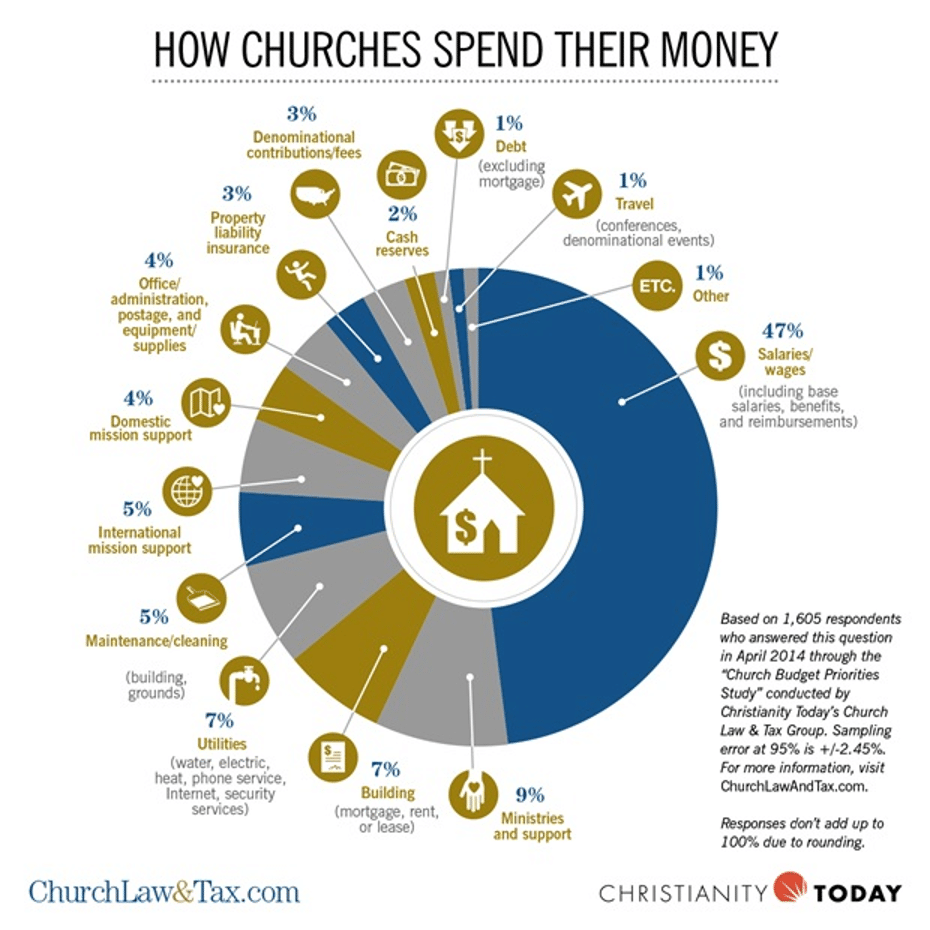

Every church is different, but again, it can be helpful to have a benchmark for how much other churches allocate toward various expenses. Below, is a breakdown of a simple look at what you might include in your overall budget. These can act as subcategories that apply to your church.

This template is based on the average growing church.

- Compensation: 40-60%

- Facilities: 35-50%

- Ministries: 5-15%

- Equipment and supplies: 5-10%

- Missions: 5-10%

Template Websites

There are really great and helpful templates for churches or any business to use when it comes to budgeting. Consider browsing each website to find a template that best suits your needs!

Steps to Create a Church Budget

1. Match Budget With Church Goals

The first step to church budgets is matching it to your church goals. This means more important programs get more funding to achieve what they set out to do. Consult with other members of the church leadership, so everyone agrees about which programs to emphasize and which ones don’t need as much money.

2. Divide Your Expenses

Your church income should be used to pay expenses before you fund any other programs. Allocate your income to your outstanding expenses first before picking which programs to fund.

Typically each church has many programs, and they can’t all be budgeted equally. Your church’s income should be divided to fund programs based on the priorities outlined during the first step.

3. Set Money Aside for Reserves and Growth Costs

After expenses and program funding, the next thing to consider is emergency reserves and future growth costs. Emergency reserves are important in case your income stream falters, while growth costs are essential for future expansion. Be sure to set aside money for both these funds once you budget for expenses and church programs.

Next Steps

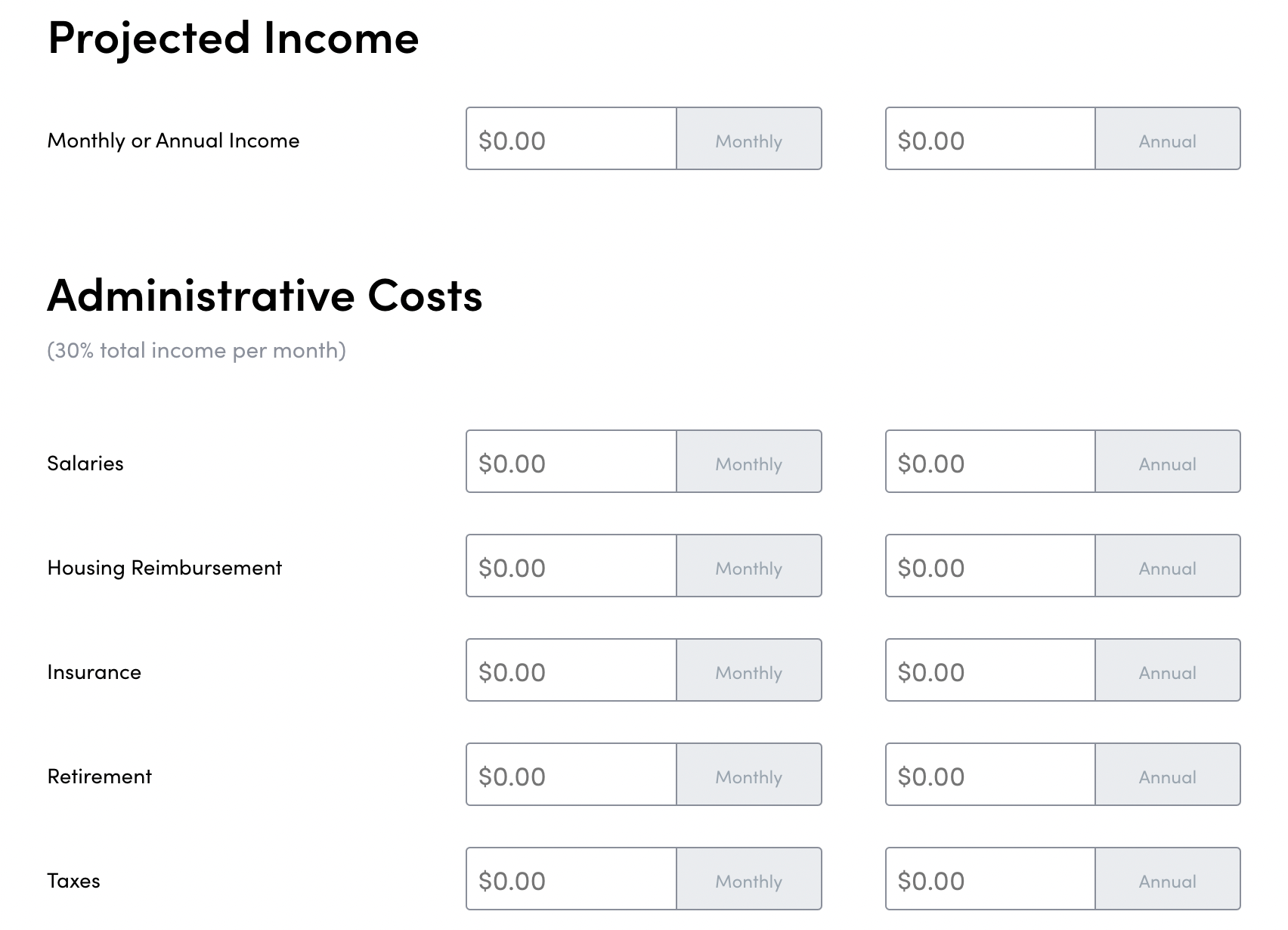

Now that you’ve identified all of your sources of income and expenses, it’s time to put that knowledge to use. Now we will need to calculate your budget baseline.

Your budget baseline starts with the income your ministry has brought in from the previous year. If you have been recording all church income throughout the years, now is the time to review that data. Run reports on the past or current year, 3 years, and 5 years of income.

First, add up all of the income your church brought in the last year. Next, subtract all of last year’s expenses from the income you just calculated. The total of last year’s income minus last year’s expenses will give you your Net Position. Ideally, this number is positive. If your Net Position is negative, it means you’ve spent more than you brought in.

Once you have your Net Position, add Last Year’s Income to your Net Position to calculate your Budget Baseline. This budget baseline is now your predicted income for next year.

Additional Tips and Tricks

Assess previous data

Look back over the previous couple years of financial data to spot patterns in income and expenditure.

Questions to ask can include:

- How much are you spending on personnel, facilities/equipment, and administration? If these areas account for more than 45%, 30%, and 10% of your spending respectively, you likely don’t have much room for spending in other areas.

- Does your church typically pay all of your expenses on time?

- Are there reserves you can dip into if needed?

- How many donations does your church receive?

- How many of these are recurring donations that your church can rely on to even out seasonal fluctuations in attendance and giving?

- How much does the average member of your church donate?

- Are there any significant fluctuations in attendance and giving?

Make Budget Cuts

Be prepared to make cuts to your church budget if necessary. Once you’ve assessed your income and expenditure, you will see usually areas that could be streamlined.

The below questions, particularly around ministries, can help –

- Are there some ministries within your church that are not effective or non-essential (in the short term, at least)?

- Are there expenses you could cut and not see a difference in terms of results? Duplicate resources across ministries is a common example of inefficient spending that can be easily addressed.

- Are your proposed cuts likely to make any roles redundant?

Appoint a finance person

Make sure someone is keeping a close eye on the finances and can account for every single cent that is spent. This person doesn’t need to have a finance background, but ideally, they’ll have a good working knowledge of budgeting and money.

You don’t need to hire a finance person on a full-time basis. For many churches, a part-time role will be enough. You could offer the responsibility to a trusted volunteer on a part-time basis with suitable experience.

Account for seasonal shifts

For most churches, there are fluctuations in attendance at certain times of the year. December usually sees a spike as does Easter. When you create your church budget, factor these shifts into account and use them to avoid tough times. During the “peak” times, you can budget to put more money aside for the lower-income months.

Raising Funds – An Essential Aspect of Church Budget

Now that you know how to spend your income, let’s discuss how to make that income possible. Tithes and offerings remain a primary source of income, but more and more churches have come to accept the necessity of fundraising for your church. Events, online campaigns, and community partnerships should all be part of your church’s fundraising plan.

For some great fundraising ideas, check out our comprehensive list!

Offer financial transparency to your members

Trust is vital to collecting funds for your church. The best way to earn this trust is by being transparent with your members. A simple way to do this is by sharing your budget online. You can strengthen trust in your church and its leadership by allowing your donors to see where their donations go and sharing how you are fulfilling your mission by spending your resources responsibly. You should also share your church’s success stories with people to help them visualize the impact.

One of the first ways you can raise more funds and increase your church’s ministry is by holding events for the public. These events can include a family carnival, a Christmas concert, or a community volunteer day.

There are several ways to raise funds at these events. Ticket sales, silent auctions, and raffles are a few fundraising options. You could also ask for donations to your church. A text-to-give campaign is an excellent way to encourage that. With text-to-give campaigns, your church can share a campaign ID and text number with event attendees or church members.

Related Links: