How do you figure out church compensation for pastors and paid staff? We’ve put this church salary guide together because we know this is a tough issue to tackle. Determining a fair total salary and what benefits to include can even be controversial.

As you’re considering all church staff positions from your senior pastor to your youth pastor to your operations director, you might be asking yourself: what should their salaries be? How do pastors get paid? While part of this will ultimately depend on your church’s budget, paying your staff fairly is vital to keeping the best employees.

If you don’t have a clue where to start or you’re re-evaluating your church’s compensation plan, read on to learn more with this church salary guide.

Looking for more information on pastor compensation? We recently published a new post all about pastor salaries. Pastor Salary Guide: How to Pay Your Pastor Right

Estimated reading time: 16 minutes

Table of contents

- Why You Need Paid Church Staff

- Common Issues With a Low Church Staff Salary

- Understanding Types Of Compensation in Churches

- Why Does Church Compensation Vary So Much?

- Common Church Staff Salary Breakdown

- Should Churches Consider Outsourcing?

- Common Mistakes Churches Make With Salaries

- Changing Your Church’s Compensation Strategy

- Resources and Tools

- Church Compensation

- Further Resources on Church Compensation

Why You Need Paid Church Staff

Unlike volunteers, your church staff is fully dedicated to helping your church succeed. Yes, volunteers do what they can, when they can, but you don’t count on them in the same way as you do your paid staff and full time ministers.

Think of it as the difference between volunteer interns and full-time employees in a business setting. Your primary staff members are tasked with the most important responsibilities. And ensuring the most significant tasks are done consistently will ultimately depend on your best employees.

When it comes to running the church, the hardest tasks are usually reserved for full-time employees. This includes the senior pastor of course! Your full-time church staff is responsible for weekend services, healthy financial stewardship, administrative tasks, building maintenance, caring for the church membership, and so much more. With all of that responsibility, it’s important to determine fair compensation and benefits.

Obviously, you may not pay every person who works in your church. For instance, you might have a few members who are copywriters who volunteer to write weekly blog posts. Or members with website builder experience who help update your church website. Giving their time and talent to support weekend services may be how they hope to serve the church.

Lifeway 2022 Compensation Study, Senior Pastor Full-time

Despite your best intentions, it’s difficult to determine how to run a church on volunteers alone. Especially for your senior pastor who may be giving 40 hours a week to ministry. What happens if a volunteer suddenly stops helping out or moves away? Most of the time with paid staff, you have more stability and a process to replace church staff.

Would you run a business on volunteers only? Not likely. You’d hire the best employees possible to given your payscale to help you build and grow a thriving business. These people give their all and deserve fair compensation in return. The hard part is figuring out what a fair salary is, especially if you’re a smaller church.

While you don’t always need a huge paid staff, you do need to determine fair pay for the church staff you have. Paying everyone fairly for what they do goes a long way towards boosting employee morale. As everyone knows, happy workers are more productive and positive. In a church environment, this means creating a winning atmosphere that cares well for church staff and volunteer workers.

Common Issues With a Low Church Staff Salary

Clearly, it’s important to determine fair pay for your church staff. But let’s be sure we understand the consequences when you underpay them. Don’t feel bad. You might not even realize you’re underpaying. Or it could be a budget constraint.

While your staff will understand lower salaries when they’re working for a small church that’s struggling to grow and make ends meet, they won’t be as understanding if you’re a thriving church with an organization that’s constantly growing.

Common obstacles that come from lower church worker salary

- Low morale

- Interpersonal conflict (especially if the payscale is unevenly distributed)

- Lack of accountability

- Loss of your best employees

- Negative attitudes that affect church culture

- Lack of availability when you need them most

These are just some of the consequences that arise when your staff find out they’re not getting fair compensation or you’re paying them far less than the standard for a church of your size. The last thing you want is for them to be so stressed about their personal finances that they can’t do their job well.

The good news is, there are ways to boost your budget to allow for better salaries for church leaders. But, more on that later on.

Understanding Types Of Compensation in Churches

Most of the time, a church salary guide just supplies an overall total salary, but it may not go into details on what’s included in that compensation package. Church compensation isn’t just a weekly or monthly pay check. Instead, it’s a total of regular pay and benefits.

Common types of benefits included in the overall salary

In addition to regular pay, most churches offer healthy insurance and other yearly benefits. Benefits are crucial for compensating your staff fairly.

- Vacation time

- Retirement, such as 401(k)

- Housing benefits or Pastors Housing Allowance

- Dental and Health insurance

All of these benefits have a monetary value. For instance, you might pay a staff member $30,000, but include $10,000 of yearly benefits for a total salary of $40,000 per year.

Often times, better benefits will make employees accept a slightly lower salary. For instance, offering vacation time doesn’t cost your church as much as a regular salary as your staff can come together to cover another employee’s position for a few days or a week.

Why Does Church Compensation Vary So Much?

So, your church is in a small town that no one even knows exists. How could you possibly pay the same type of salary as a church in Los Angeles? You can’t.

Average pay is just that – average. Before you even look at the average salary for different positions, it’s important to understand the factors that go into determining what a staff member should make.

Top Salary Considerations

One of the top considerations is the cost of living in your specific area. A rural church is typically in an area with a lower cost of living than a church in a major city. This can change the annual salary by $10,000 or more.

Other Salary Considerations

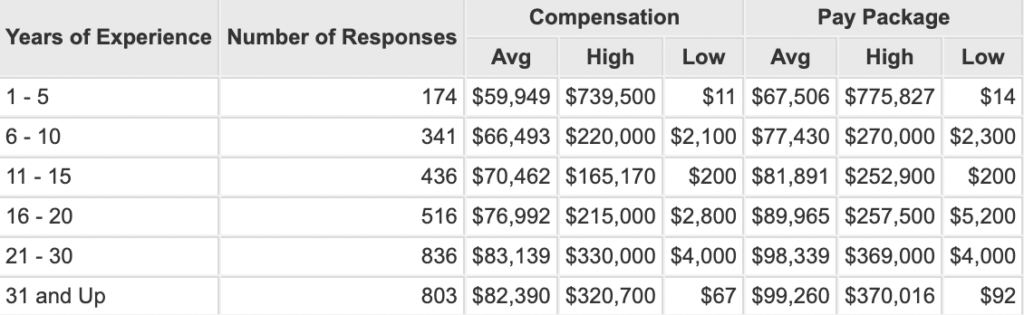

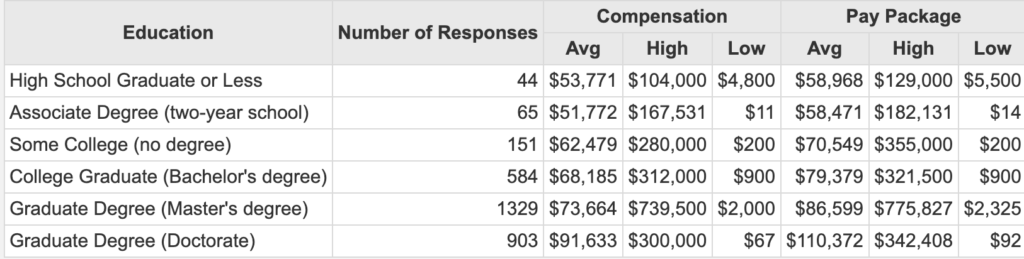

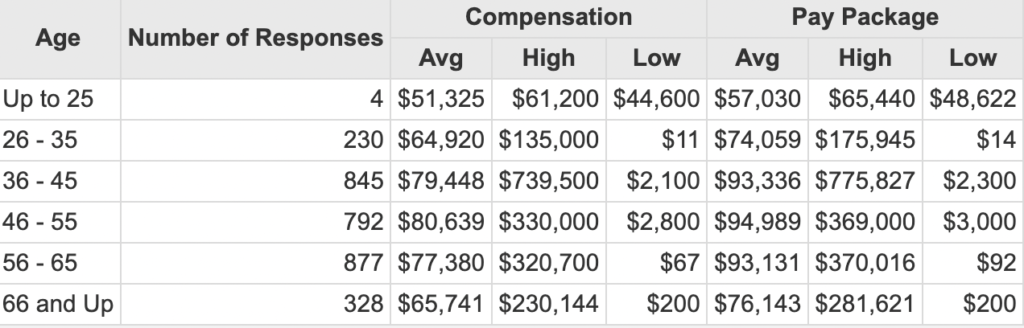

Lifeway 2022 Compensation Study, Senior Pastor Full-Time

- Education level

- Experience

- Type of responsibilities

- Amount of time needed

- Your overall church budget

- Average attendance

- In-church tithing and online tithing

As you can see, all of these factors drastically change how much a person is paid. A tiny church with 100 members won’t be able to pay the same salaries or even have as many employees as a mega church with thousands of members. Or a church located in a major city. That’s okay. You just have to determine the right church compensation and salary for your church.

Just remember, always re-evaluate salaries as your church grows. A bigger church means more responsibilities and the need for higher pay.

Common Church Staff Salary Breakdown

Now for the main event – the average church staff salary breakdown. Remember, these are averages and not the exact amount you have to pay anyone.

According to Lifeway, and a study published by Pushpay and Vanderbloemen, this is the average compensation for some of the following common positions based on attendance:

Senior Pastor

- 1 to 150 members – $35,494 to $67,221

- 150 to 300 members – $75,624 to $83,533

- 300 to 500 members – $96,656

- 501 to 999 members – $120,485

- Over 1,000 members – $162,761

Executive Pastor

- Up to 500 members – $54,055 to $94,756

- 501 to 1,200 members – $66,234 to $96,966

- Over 1,200 members – $84,325 to $135,065

Worship Pastor

- Up to 500 members – $45,999 to $62,745

- 501 to 1,200 members – $52,909 to $83,975

- Over 1,200 members – $54,022 to $92,291

Student Pastor

- Up to 500 members – $35,088 to $62,859

- 501 to 1,200 members – $45,956 to $64,641

- Over 1,200 members – $47,423 to $75,365

Children’s Pastor

- Up to 500 members – $33,972 to $58,623

- 501 to 1,200 members – $42,840 to $70,220

- Over 1,200 members – $48,915 to $79,900

Payscale lists the overall Christian worker salary as $51,000. However, total salary will vary based on location, job title, and years experience.

For further guidance on helping you plan your staffing budget and determining overall Christian worker salary standards, try Guidestone’s church compensation guides and templates for financial planning. This is a great resource for helping you determine what salaries work best for your needs, your staff and your budget.

As you might have noticed, the salaries reported by churches are often limited to pastors. However, you likely have a numerous other positions in operations, finance, maintenance, and administrative support.

Lifeway 2022 Compensation Study, Senior Pastor Full-Time

Sometimes, the other tasks you need done can be outsourced for much less than a full-time salary. Plus, with outsourcing, you don’t have to supply about benefits.

Should Churches Consider Outsourcing?

Your pastors can handle some administrative work, but not everything. After all, that’s not always their skill set. Plus, your pastors are probably already overwhelmed with the vital tasks required of their job position like preaching, teaching, and ministering to people. Allowing pastors to have more time for what truly matters is what helps set a church apart and increase membership.

This is where outsourcing helps. You can hire people with specific skills to handle certain tasks. They may only work a few hours a week and that’s enough to get the job done.

Examples of Outsourcing or Contract Workers

For instance, you could hire a dedicated person and pay a full-time salary for them to handle website maintenance. However, you don’t really need a full-time person for this. We previously talked about ways to make this task easier and one of our recommendations was to outsource to save money and ensure you don’t miss anything.

Often, outsourced administrative support positions are referred to as virtual assistants. They can handle everything from accounting to uploading content on your website. You may hire several different virtual assistants based on skillset and that’s okay. Odds are, you’ll still pay less than a single salary for an entire year.

Go ahead and explore outsourcing for the tasks you need skilled talent for, but don’t have the budget or need for full-time staff. This is a great alternative to volunteers for tasks that you need regular, dedicated support. Remember when outsourcing, the cheapest option isn’t always the best. A middle of the road price typically offers the best of both quality and price.

Common Mistakes Churches Make With Salaries

Paying your church staff a fair overall salary isn’t always the problem. It’s how and what you pay them that makes or breaks the situation. For instance

- When was the last time you gave your staff a raise?

- Do you do performance reviews?

- What about annual incentives?

Even with the best intentions, you could be making mistakes that hurt your staff and church in the long run. That’s why it’s vital to determine fair pay!

Thom Rainer broke down some interesting findings on church salaries, such as:

- Growing churches pay their staff less than declining churches

- There’s a 76:1 ratio when it comes to members to staff

- Staffing budgets have decreased to 49% of the overall budget

The first point is an obvious problem, yet not surprising. After all, you might pay staff more in the hopes they’ll draw in more members in a declining church. However, a growing church should be paying their staff more as their budget increases.

Often times, having too few staff in relation to number of members is overwhelming and can lead to burnout. This, of course, is another reason to outsource some tasks and make it easier for your staff to minister to your members and community.

Now, the last point isn’t so bad. Most of that is coming from an increase in outsourcing. That just means fewer people have to split that 49%.

Some of the worst salary mistakes churches make

- Poorly planned incentives, such as a set amount per new volunteer or member (the right incentives do make a difference, though)

- Paying one person exorbitantly more than someone with similar responsibilities

- Hiring more people than you can afford and paying everyone less as a result

- Rarely giving any type of raise

- Not explaining your church budget to staff (helps them understand why they’re paid what they are)

- Not taking salary concerns seriously when someone does complain

- Trying to replace your core staff with volunteers to save money

Most of these mistakes happen as a way to either keep someone truly special or to save money. However, these mistakes have a way of backfiring and wreaking havoc on your church’s budget. Healthy financial stewardship is vital in the long run!

Changing Your Church’s Compensation Strategy

If you feel like you’re under or even overpaying your staff, or you’re making some of the mistakes above, it might be time to overhaul your church’s compensation strategy.

Smart Church Management provides guidance on creating a basic strategy and for establishing final salaries. These guides work well for helping you get started on a brand new strategy.

Part of your strategy should include ways to boost your budget so you can pay fairer wages. Some great ideas include:

- Limit your staff to what you need (a small church won’t need the same staffing structure as a larger church)

- Ask for volunteers for certain tasks, such as blogging, monitoring social media and community outreach

- Outsource when possible

- Have a strategy to increase online giving

- Focus on retaining your members versus just bringing in new ones (engaged members help bring in new members on their own)

- Eliminate unnecessary programs to put your budget towards more successful and well-received programs

Remember that no matter what your strategy is right now, it’s important to review it annually. As your church changes, so do your salary needs. From your senior pastor to your worship pastor to your youth pastor, and everyone else on your church staff, be sure to review salaries yearly and offer raises when possible, even if it’s just 1%.

Your staff will appreciate it, even if it’s still below average. This is especially true if you share your budget and let them know that you’re trying your best.

Resources and Tools

When it comes to navigating the complexities of church staff compensation, having access to the right resources and tools is paramount. Let’s explore some invaluable resources and tools that can aid churches in making informed and equitable compensation decisions.

Compensation Benchmarking Tools

- GuideStar and ECFA (Evangelical Council for Financial Accountability) provide data on compensation trends within the nonprofit and religious sectors.

- LifeWay Research offers salary surveys specifically tailored for church staff positions.

- Utilize these tools to gain insights into how your compensation packages compare to those of similar-sized congregations or denominations.

Sample Compensation Policies and Guidelines

- The Christian Ministry Salary Survey often includes sample compensation policies and guidelines.

- Many denominations and religious organizations offer templates for creating comprehensive compensation policies.

- These resources can serve as a foundation for establishing fair and ethical guidelines that align with your church’s mission and values.

Legal and Tax Resources

- The IRS provides information on tax-exempt status, tax implications for clergy, and compliance guidelines for religious organizations.

- Consider consulting organizations like Church Law & Tax for legal guidance and resources tailored to churches and nonprofit organizations.

- Staying informed about legal and tax considerations is crucial to avoid potential pitfalls in compensation management.

Professional Organizations

- Joining professional organizations like theNACBA (National Association of Church Business Administration)can be beneficial.

- NACBA offers resources, webinars, and networking opportunities specifically focused on church administration, including compensation.

- Membership in such organizations can provide access to a wealth of resources and support from experts in the field.

Financial Planning and Consulting Services

- Explore financial advisory firms or consultants with experience in working with religious organizations.

- These professionals can offer tailored guidance on developing sound compensation packages, budgeting, and financial strategies that align with your church’s goals.

Online Communities and Forums

- Platforms like the TCN (The Church Network) host discussions and forums where church leaders can seek advice and share experiences related to compensation.

- Engaging in online communities can help you tap into collective wisdom and find solutions to complex compensation challenges.

Continuing Education and Workshops

- Look for institutions or organizations that offer training and workshops on church administration, including compensation topics.

- Investing in ongoing education ensures that you stay updated on best practices and legal changes that may impact compensation decisions.

Books and Publications

- Consider reading books such as “Compensation Handbook for Church Staff” by Jason E. Mandryk or articles from publications like “Church Law & Tax Report” to deepen your understanding of church staff compensation.

Case Studies and Success Stories

- Learning from real-life examples can be inspiring and instructive. Seek out case studies and success stories from churches that have effectively managed their staff compensation.

Financial Software and Tools

- Explore accounting and payroll software designed for churches and nonprofit organizations, such as Aplos or QuickBooks Nonprofit.

- These tools can streamline compensation management, ensure compliance, and simplify financial reporting.

Seminars and Webinars

- Keep an eye out for upcoming seminars and webinars focused on church staff compensation.

- Participating in these events can provide you with up-to-date information and insights from experts in the field.

Key Contacts and Consultants

- Don’t hesitate to reach out to consultants or experts specializing in church staff compensation, tax, and legal matters.

- These professionals can provide personalized guidance tailored to your church’s unique circumstances.

Having access to these resources and tools empowers churches to make informed, fair, and legally compliant compensation decisions, fostering a healthy and thriving church community.

Church Compensation

Navigating the intricate landscape of church compensation and church salary is both a big responsibility and an opportunity for growth. It reflects the core values and mission of your congregation while ensuring the well-being of those who dedicate their lives to your church’s service.

As you embark on this journey, remember that transparency, fairness, and staying informed are your guiding lights. By utilizing the resources and tools at your disposal, consulting experts, and continuously learning, you can cultivate a culture of trust and support within your church community.

In doing so, you not only honor the dedication of your staff but also strengthen the foundation upon which your church’s mission is built. May this guide serve as a steadfast companion on your path to achieving equitable and harmonious church staff compensation.

Are you looking to outsource your church website design? Contact our team today to learn how we can help.

Comments 26

Is there a similar resource available showing how compensation should work in churches that require staff fundraising? For example, if the church employs ministers as independent contractors who raise funds from the community, then has the church consolidate donations as a fund to pay out to the ministers? Can the church managing the fund use the contractor’s living expenses as a basis for setting salary in addition to experience and performance?

I have several friends who raise their own salary to get paid out through the church that employs them, and they’re required to show their personal finances each year to establish their expenses. This is often down to the level of discussing how much they spend on haircuts or whether they’re clipping coupons, not just regional cost of living or national averages. The church employs about 30-50 full time staff this way for a church no bigger than 300 members. It’s not consistent with the modeling above and seems ‘off’.

Can you please provide me with any strategies for determining staff compensation package as it relates to health benefits and other non salary items. I’m looking for samples also that shows total compensation packages.

Blessings

Looking for information on how we should pay our Sr. Pastor. The other question should we offer him a bonus and what should it based on.

Can a church require a salaried employee to work on Sundays but then not get paid for them?

Sunday duties are part of their weekly duties, staff must request to be gone on Sundays but very frowned upon when missing a Sunday.

Author

It is generally not legal for an employer to require an employee to work on a day that is recognized as a day of rest in their place of work, such as Sunday, and not pay the employee for that work. Under federal and state labor laws, employers are required to pay their employees for all hours worked, including hours worked on weekends and holidays.

If an employee is required to work on a day that is recognized as a day of rest in their place of work, the employee must be paid at least the minimum wage for those hours worked. If the employee is a salaried employee, the employer would typically need to pay the employee their regular salary for hours worked on days of rest, unless the employee and employer have agreed to a different arrangement in writing.

It is important to note that there are some exceptions to these general rules, so it is always a good idea to check with an attorney or your state’s labor department for specific guidance.

Hello – What is the average salary for the multimedia director that handles sound, visual aids and livestream support ?

You did not mention salaries for Directors of Women’s Ministries. Our church has 15 different ministries of outreach to women. With over 600 women and 11 different coordinators. This person is also over all women’s events, retreats, etc. This does not include any children ministry. What does this look like in other churches? This seems to me to be a full-time position. Any information you might have on salaries etc. would be appreciated.

This is extremly valuable information. Thank you so much for posting this!

Author

Glad it was helpful. Thanks for the encouragement, Ken!

Hello, I am look for a salary/compensation package for a minister of music (executive level of responsibility) at a church running 3,000+. Years of experience – 25+. Education: doctorate. Has served a churches with average attendance of 5k-9k for 20 years and led a music department with over 1,000 active participants. State inquiring about is Florida. Thank you!

Why is the pastor generally the highest paid person in the church? Specifically, a large church? IT Directors, Communications directors, finance managers, etc often command more compensation in society. Pastors less. But in a church the pastor salary seems to be what everyone else’s compensation is based on.

Looking to learn how much to pay a pastor in McKinney, Tx. 1,000 in church attendance.

Hi

With a tax exempt church, is there a limit on the percentage a pastor can make related to the total amount the church receives?

What to do when it appears an individual employee is receiving a larger amount of money because they had given a very large contribution to the church. I believe the extra money is not being paid because of working more hours or doing a better job, but because of the timing, it is because of what was given to the church. What is the law regulating this matter

Author

Great question Wilma. Sounds fishy, but I can’t speak to the legality of the situation. Maybe someone in the REACHRIGHT community has some feedback.

Thank you for a great article. Can I ask where you got your data and how many churches did you sample?

Author

Hey Mark, We linked to a few sources in the article, but most of the data comes from Vanderbloemen and Lifeway.

I am looking for a church compensation handbook for church staff. Please call me at 630-***-****

Helpful article, thanx.

Question: You listed ‘education’ as an important consideration; any info available about this?

I’m embarking on an AA in Biblical Studies, but haven’t seen an AA as a valid education in most church staffing requirements. What do you know?

Thanx again.

can a church give “gift cards” instead of a salary. We have four members of our church that receive gift cards each month instead of salary. The church’s reasoning if so the staff doesn’t have to pay taxes.

The real question is “should” they give gift cards as compensation. This is a moral question, and the sad reality is churches don’t always fair well in doing what’s right and good by staff in terms of compensation. So they come up with these kinds of strategies to make it sound like they’re helping staff save money, but that’s not really the case. It actually harms staff and the church for multiple reasons.

First, not paying taxes keeps the staffer from logging years with the IRS towards social security. Never encourage your staff to opt out. It’s really bad advice, and they’re regret it. Don’t ask them to do what you wouldn’t yourself do: this violates the golden rule. Pay them a wage, so that they can get IRS benefits. Frankly, given how low most salaries are, they won’t pay much in taxes any way.

Second, people deserve to be paid so that they can manage their own finances. There’s something crass about giving gift cards which forces them into a corner of how they spend they’re hard-earned wages. You wouldn’t want that, so don’t do that to staff.

Third, churches don’t like to admit it, but it costs THEM less to do it this way. Are you trying to avoid paying into a retirement account, or to pay health insurance, or avoid other benefits? If so, shame on you. Pay them a legit salary with benefits. If you want to give gift cards as an added “blessing”, then good on you, but don’t try to save money by robbing your staff. There is a good scriptural basis for giving staff “double honor,” yet churches seem to begrudge paying people.

Finally, this model wreaks of the whole “we will keep you poor, if you stay humble” approach. This should’ve died decades ago, but it’s abusive to staff. No other industry would tolerate this, and staff would leave in droves. High turnover results from resentment and burnout for mistreatment. Financial mistreatment is one common problem with people leaving churches and church ministry altogether. Why would someone stay a youth pastor, for example, on much less than they could make as a school teacher with summers off? Think about that. It happens all the time. Invest in your staff. Love your staff. Help them grow. Paying them well serves all of these ends!

Good morning, I am looking for a salary for Senior Pastor of 25 years of a congregation of 225 people in Detroit, MI.

Hello, I’m looking for a salary for the State of Georgia for a congregation of 500 people – Senior Pastor.

Salary + Benefits = $150,000 to $175,000

Very detailed informative report which is truly usable. As a church board member of a 500 member church the information will come in useful in guiding the salary review team in making critical decisions.

Author

So glad it was helpful Dean. Staffing decisions can be the hardest!