Is your church managing its finances correctly?

It’s 2024, and financial stewardship for churches is becoming more important than ever. What does it even look like these days? What’s important? What’s not?

Church financial management in 2024 focuses on using modern tools and strategies to ensure stability and growth. Managing church finances has become more complex, with many congregations relying on digital giving platforms, transparent budgeting, and new software.

It’s crucial for church leaders to understand the changing landscape to keep the church’s finances in good shape. With inflation and changing donor behaviors, financial management requires a strategic approach, balancing day-to-day needs with long-term goals.

Understanding church finances helps leaders make wise decisions that align with their mission while ensuring that resources are used effectively.

In this podcast, we’ll look at financial reports for churches to get an understanding of our situation, then dive into some tips for effective church financial management.

Estimated reading time: 10 minutes

Table of contents

Church Finances: The Stats

When looking at church financial management in 2024, we need to look at the numbers. What do the statistics say about finances? How can we use these numbers to help in our financial planning?

Giving Sources

First up, we have to look at where the money is coming from. Churches are getting financed somehow. In most cases, this looks like tithes and offerings collected from members.

According to Philanthropy Outlook (via Vanco), 49% of the U.S. population gives to religious organizations. That’s almost half of all Americans! Pretty awesome, right? However, its not as high as its always been.

According to the New York Times (also via Vanco), the share of overall donations going to religious organizations dropped by 50% between 1990 and 2015.

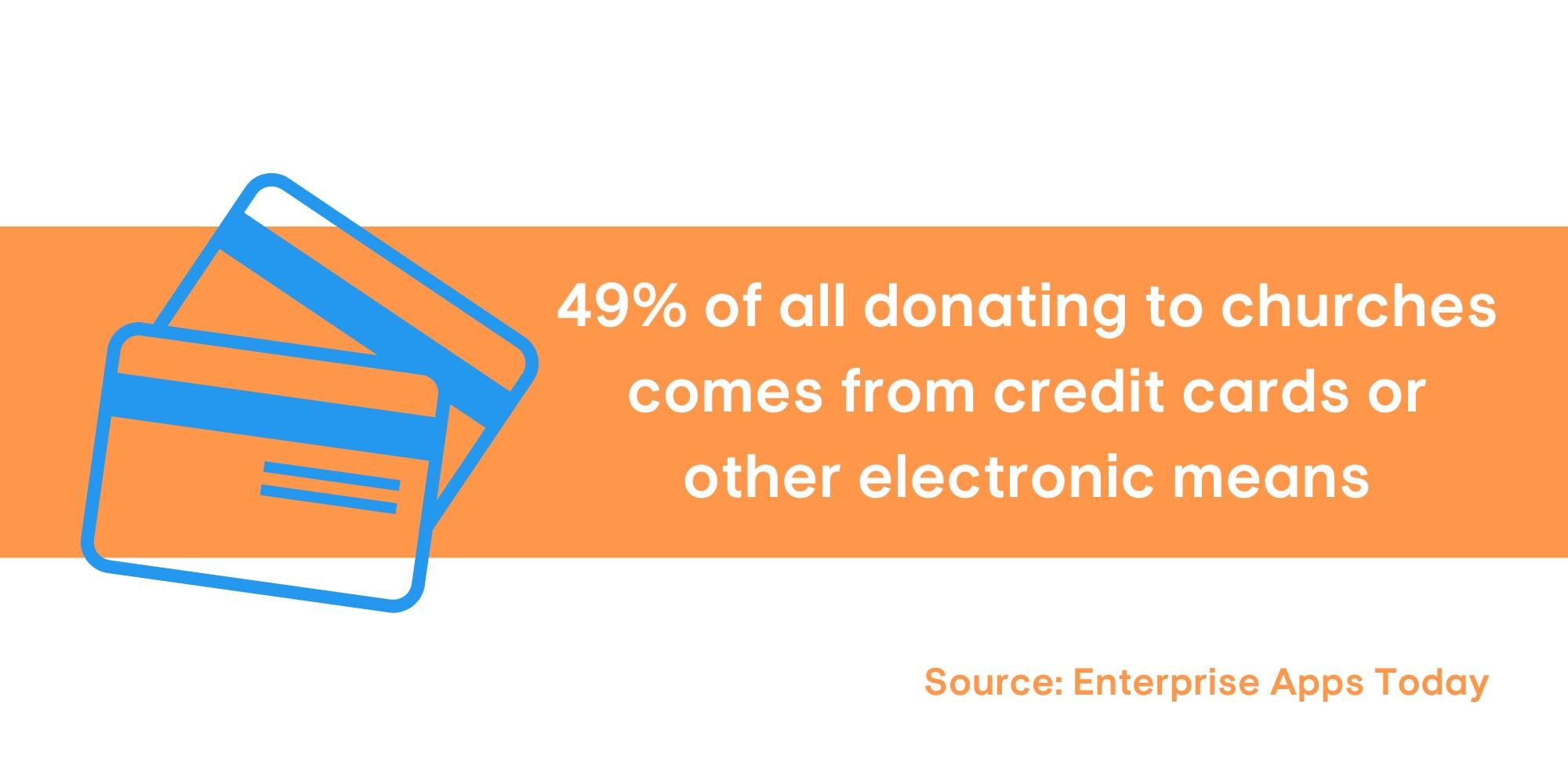

Looking at stats from Enterprise Apps Today (via ChurchTrac), we see that 49% of all donations to churches are given by credit cards or other electronic ways, while 40% come from in-person cash or checks.

Speaking of digital giving, churchgoers ages 35-44 are 2x as likely to give with an app compared to those age 24-34 (according to the Vanco Churchgoer Giving Study). Statistics also show that adding an online giving option increases church donations by 32% (according to Nonprofits Source).

According to the U.S. Bank Study (via Vanco), 76% of people don’t carry more than $50 in cash at any given time. This makes it extra important that your church has online giving options!

However, even with as many giving options as possible, it’s important to know that according to Nonprofit Source, only about 10-25% of church members tithe.

How Much Are People Giving?

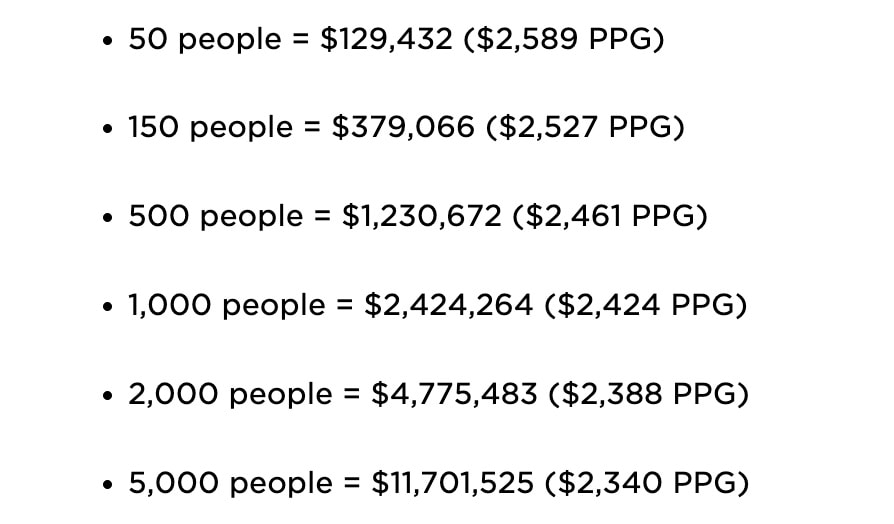

ChurchSalary reports that churches of 50 people saw $2,589 as average per-person giving, while churches of 5,000 in attendance reported an average per-person giving of $2,340. Here is their image that breaks things down into even more detail. For reference, PPG means “per person giving”.

It’s clear that per-person giving is higher for smaller churches than it is for bigger churches. Therefore the average church size of 125 or fewer people sees average annual per person giving over $2500.

To break things down even more, according to Health Research Funding, average tithing by adults in U.S. Protestant churches is ~$17 a week.

Your church can use these numbers to help estimate how much income it will make. If you know an estimate of your church’s financial resources, you will be able to spend your church’s funds more wisely and never go over budget.

Despite these stats being helpful, we encourage you to keep track of your own numbers and find averages and trends you can use.

How Do Churches Spend Their Income?

So now we know where the money is coming from and how much churches are making. But what do most churches do with their money?

According to ChurchSalary, churches usually spend 40-60% of their budget on payroll, with 49.1% being the average.

However according to the same source, the smaller the church, the less is spent on payroll.

According to Vanderbloemen, 45%-55% spent on staff salary is healthy for mid-to-large sized churches. But for smaller churches of 50 members or less, churches may spend 0% of their budget on their pastor or as high as 60%.

The rest of a church’s budget can be spent on rent, building upkeep, ministry resources, events, and more. It is entirely up to each church and what they want to prioritize.

Church Finances

And that’s all the stats you need to know about your church’s financial health. We hope that the numbers can help your church’s financial planning when determining income and spending money. Of course, a church’s financial situation is more than just statistics, it can be affected by any number of other factors.

We encourage you to conduct your own financial reporting and find your own numbers for your church. When you are better informed on the money coming and out of your church, you can adjust your strategies and grow in a healthy way.

Tips for Healthy Financial Management

Now that we’ve covered all the stats, it’s time to get into tips and tricks to help you manage your church’s finances in a healthy way. You can use as many or as little of these tips as you like as you find what works best for you and your church.

Managing church finances wisely is essential for maintaining a healthy and stable church community. Here are the top 5 tips for managing church finances in a straightforward and effective way:

1. Build an Emergency Fund

Having an emergency fund is crucial for any church. It acts as a financial cushion, helping the church manage unexpected expenses like repairs or sudden drops in donations. Building this fund requires setting aside a portion of income each month until it can cover at least three to six months of basic expenses.

This ensures the church can continue its activities smoothly even during tough times. Using this fund strictly for emergencies is key to keeping the church financially stable.

2. Create a Church Financial Planning Strategy

Church financial planning means setting clear goals for the church’s budget, both in the short term and long term. This involves identifying key expenses like building maintenance, staff salaries, and community outreach.

When we look at the stats in the previous section, we see that spending 45-55% of your church’s budget on salaries is a healthy amount. If your church is over this amount, how can you find ways to get it as close to this percentage as possible? If your church is far under this amount, you might be overworking your staff and can handle hiring a few more people to help balance the workload.

Planning helps to align the church’s spending with its goals and available resources. Regularly reviewing the plan ensures that the church can adapt to any changes in income or needs, keeping finances on track and preventing overspending.

3. Set Up Online Giving Solutions

When we look at the stats in the previous section, we can see how important it is to offer online giving options. If about 50% of all donations coming into churches comes from electronic means, then you need those electronic means right now!

If your church doesn’t have online giving options, or they’re not easy to use, you could be missing out on tons of extra tithes! If the stats say that adding an online giving option increases giving by 32%, why would you not?

If you need help choosing the right provider, check out our article on choosing the right online giving platform for you.

4. Budget Based on Your Church Size

We all know how important it is to spend within a budget. Well, that budget is going to look different for every church. A large factor in this is the size of the church. Quite simply, smaller churches make less money from tithing than bigger churches. At the same time, larger churches may have bigger expenses (such as paying for a bigger space).

When we looked at our statistics, we saw how much church size affected different factors. The less people that attended the church, the more likely they were to give more money. The bigger the church, the less money it got per person per year. In addition, smaller churches seem to spend less on staff salaries than bigger churches.

It’s important to keep all of these factors in mind when creating a budget. How does your church size affect how much money you make and how much you spend?

5. Promote Generosity While Practicing Stewardship

Encouraging the congregation to give generously is important for sustaining the church’s mission, but it’s equally important for the church to be a wise steward of those donations. This means using the funds in a way that directly supports the church’s work and makes a positive impact on the community.

Being transparent with members about how their contributions are being used fosters trust and encourages ongoing support. This balance between promoting giving and managing funds responsibly helps maintain a healthy financial environment for the church.

In the previous section, we looked at the averages for giving in churches. If your church is making less than that, you may need to promote tithing and offering more at your services! If your church is making the average or above-average amount but you always find yourself low on funds, look at how you’re spending that money. Where are there places you can cut back on spending?

By focusing on these five tips, churches can build a solid financial foundation, ensuring they are well-prepared for challenges while continuing to serve their community effectively.

Managing Church Funds

In conclusion, effective church financial management is crucial for maintaining stability and supporting the church’s mission. Understanding the statistics around common financial challenges helps church leadership make informed decisions, while implementing practical solutions like creating an emergency fund, involving church leaders in financial planning, and maintaining accurate records ensures a solid financial foundation.

By promoting generosity and practicing good stewardship, churches can make the most of their resources and continue to grow. With the right strategies, churches can overcome financial hurdles, build a stronger community, and stay prepared for whatever the future holds.

More on Church Finances