When it comes to your church’s finances, you want to be responsible. It’s no small thing to manage church accounts. Church management and expense tracking are vital roles that may get overlooked. We put together a list of 9 of the best church accounting software vendors.

Church software can sometimes feel confusing, and we hope that by breaking down what each vendor has to offer, you’ll pick the right choice for your church!

Estimated reading time: 12 minutes

Table of contents

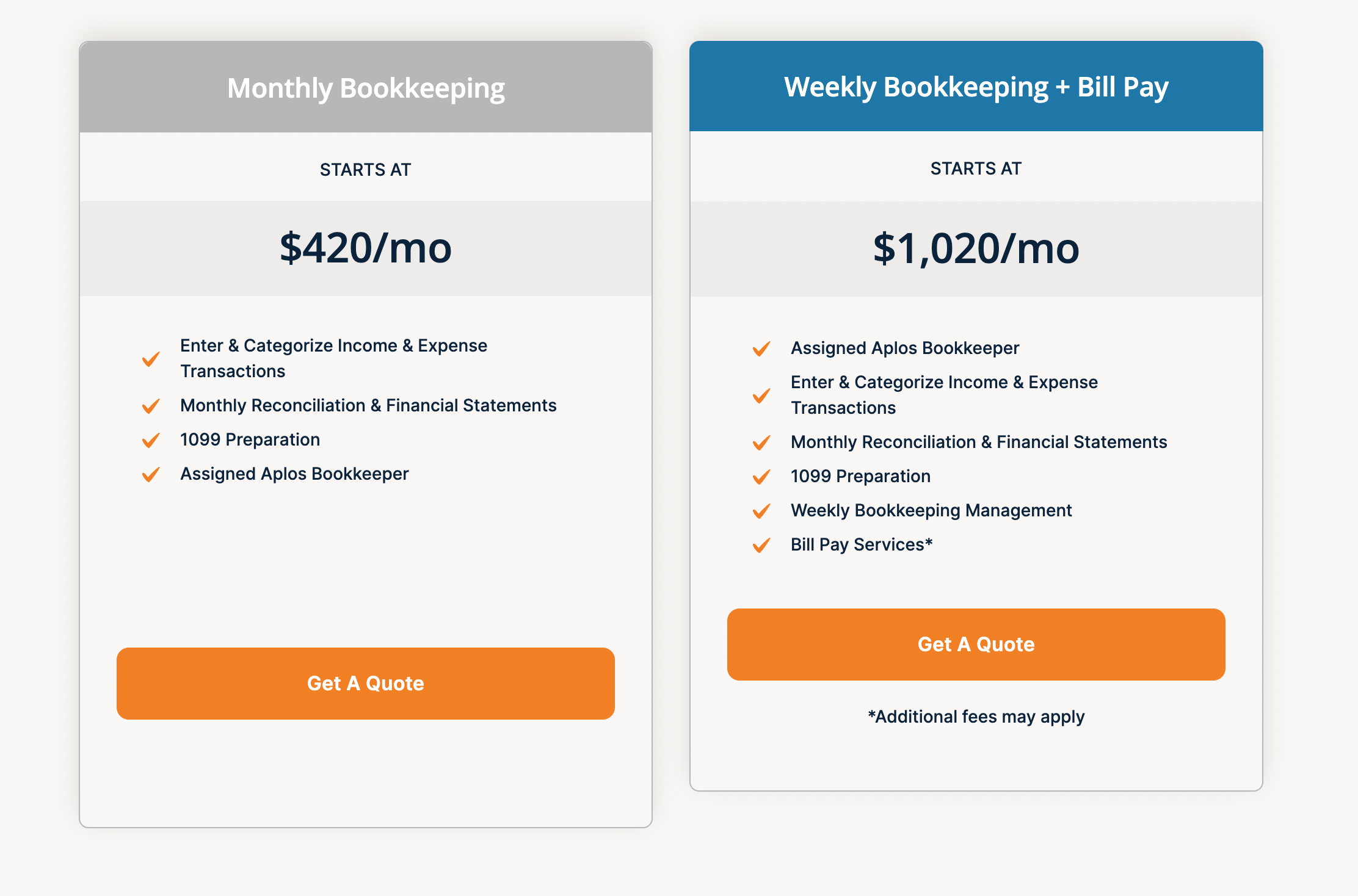

1. Aplos

Aplos was built by a CPA and executive pastor, so they understand quite well that churches have unique accounting needs. That’s why Aplos church accounting software makes it simple for you to do accounting the right way. Their expense management software is highly recommended and used widely by hundreds of churches.

True fund accounting

Easily track designated funds, such as your missions fund or building fund, to demonstrate to your members that you are stewarding your gifts well.

Integrated payroll

Utilize their payroll integration with Gusto to easily process pastoral payroll, housing allowances, and make tax payments.

Complete church bookkeeping

All the tools you need to work quickly and manage your finances:

- Import transactions from your bank

- Journal entry for fund transfers and payroll imports

- Track and pay bills

- Create invoices and receive payments online

- Print checks

- Bank reconciliation

- Track 1099s

How it works:

- Aplos will set up your accounting to achieve the financial reports you need.

- Aplos will categorize your transactions for you and request information for any items that need more details.

- They will reconcile your bank accounts to prepare your balance sheet, income statement and other financial reports upon request, as well as advise you on how to read your reports.

- Each year they are able to prepare and send 1099s upon request and send annual reports.

- If needed, they can even help with tracking your donations, paying bills and accounting for your payroll.

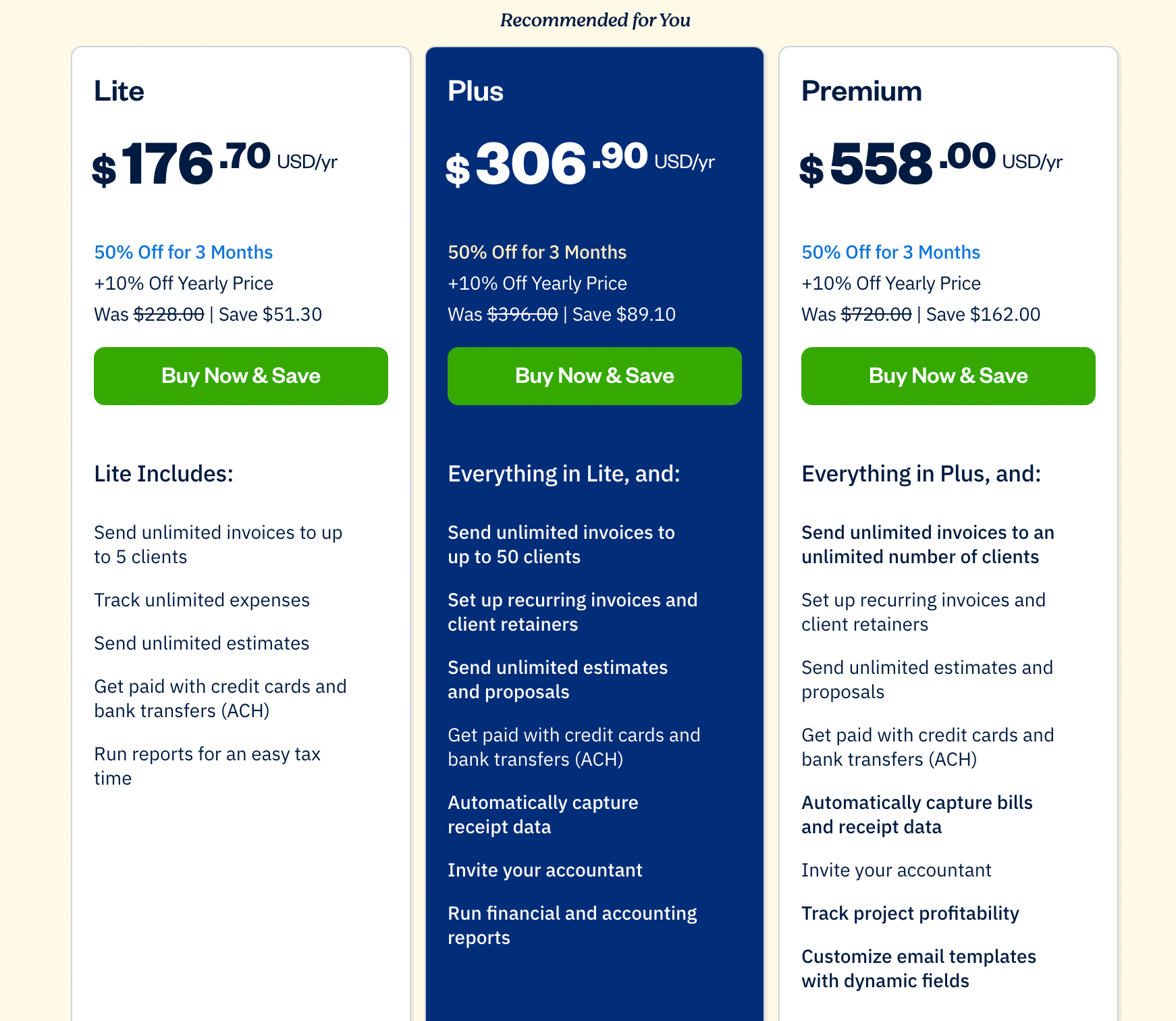

2. Fresh Books

Simple or complex, your finances tell you how your business is doing. FreshBooks’ Double-Entry Accounting tools and reports show profitability, cash flow health, and details your spending.

FreshBooks’ Double-Entry Accounting gives you everything you need to stay

organized for tax time, stay compliant with regulations, and make decisions based

on up-to-date insights. With a customizable Chart of Accounts, you can keep track of every

number as your business grows.

- Balance Sheet

- Trial Balance

- General Ledger

- Accounts Payable

- Cost of Goods Sold

- Chart of Accounts

- Accountant Access

- Journal Entries

See where you stand without having to loop in an accountant. With FreshBooks, you can confidently stay on top of the health of your business, make choices based on insights, and understand the costs of running your business—all at a glance. Create accounting reports and use the accounting tools in FreshBooks so you always know the costs of running your business.

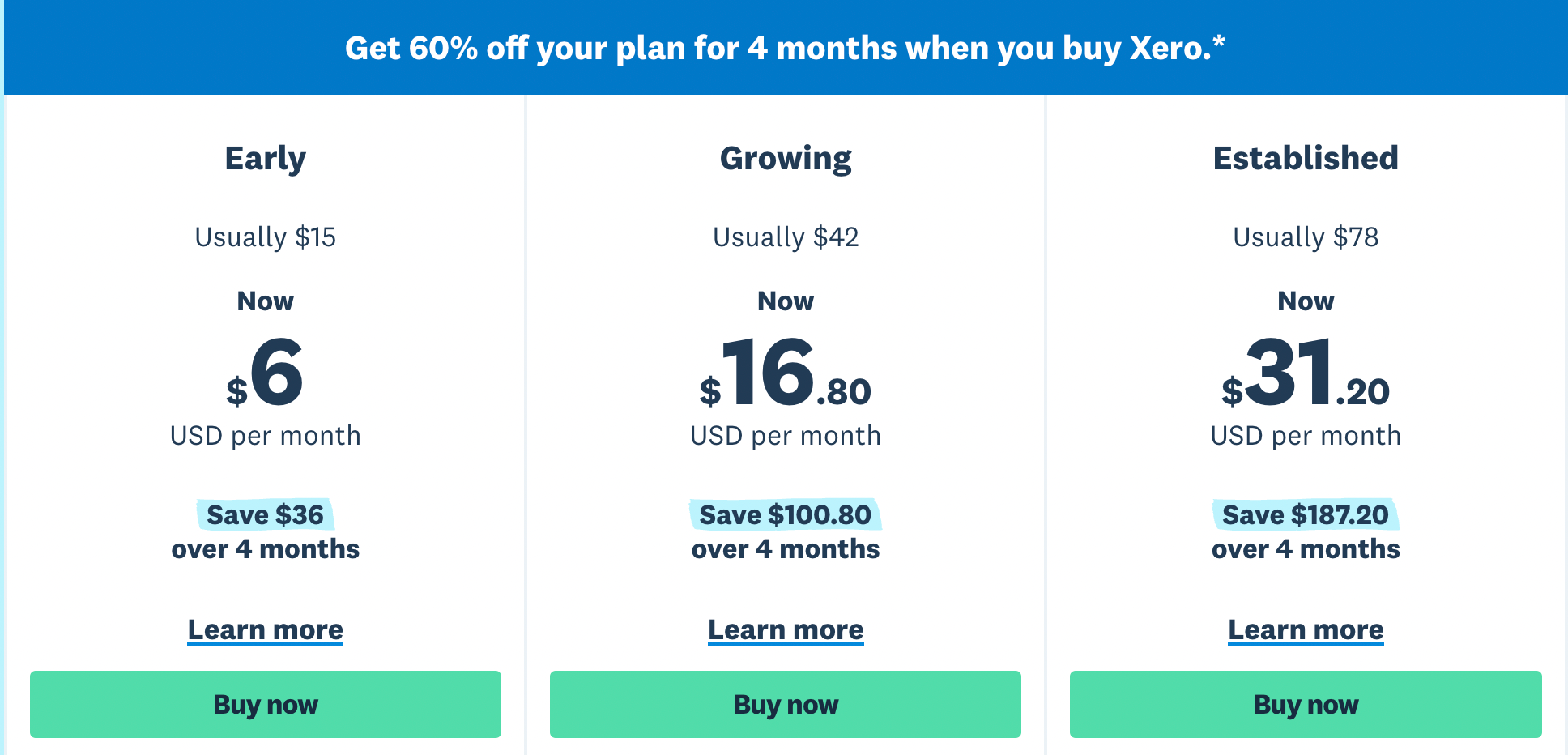

3. Xero

Xero is a top leader in accounting software. For any of your financial reporting, this is a great church accounting system. With all of your key information synced and real-time view of cash flow. You’ll also be able to customize to suit your needs and connect Xero to your bank for automatic bank feeds. As well as easily sync bank and financial information.

View a summary of money coming in and going out on the Xero dashboard, and in cash flow reports. Access over 1000 apps in the Xero App Store to streamline tasks.

Online invoicing

Work smarter with Xero’s intuitive invoicing software. With Xero online accounting, you can send invoices, automate reminders and so much more from the comfort of your desktop or mobile app. Finish your invoice admin at a time that works for you and your small business.

Pay bills

Track and pay bills on time. And get a clear overview of accounts payable and cash flow.

Inventory

Keep accurate track of stock levels with Xero’s inventory software, where you can also populate invoices and orders with items you buy and sell.

4. Intuit QuickBooks Online

Quickbooks Online is a great accounting solution with tools that can assist church leaders with budgeting, payroll management, and expense tracking. The software offers a class-tracking feature that uses fund accounting to help churches track accounting transactions by departments, funds, or programs. You can set up classes for different projects within the church to get an overview of the income and expenses for each project separately.

Product features of interest:

- Cash flow management: Automatically track the amount you owe stakeholders, such as congregation members and vendors, to ensure that the bills are paid on time. This software also helps you spot trends in your cash flows and assess past data to manage your budget.

- Expense categorization: Sort your expenses into categories, such as rent and supplies, to keep your financial data organized. With this feature, church members can track their expenditures at any time of the year and ensure they never miss an important tax deduction!

- Donation management: Accept donations online via credit, debit, and automated clearing house transactions. Users can also tag donations to specific funds and programs to refer them whenever required.

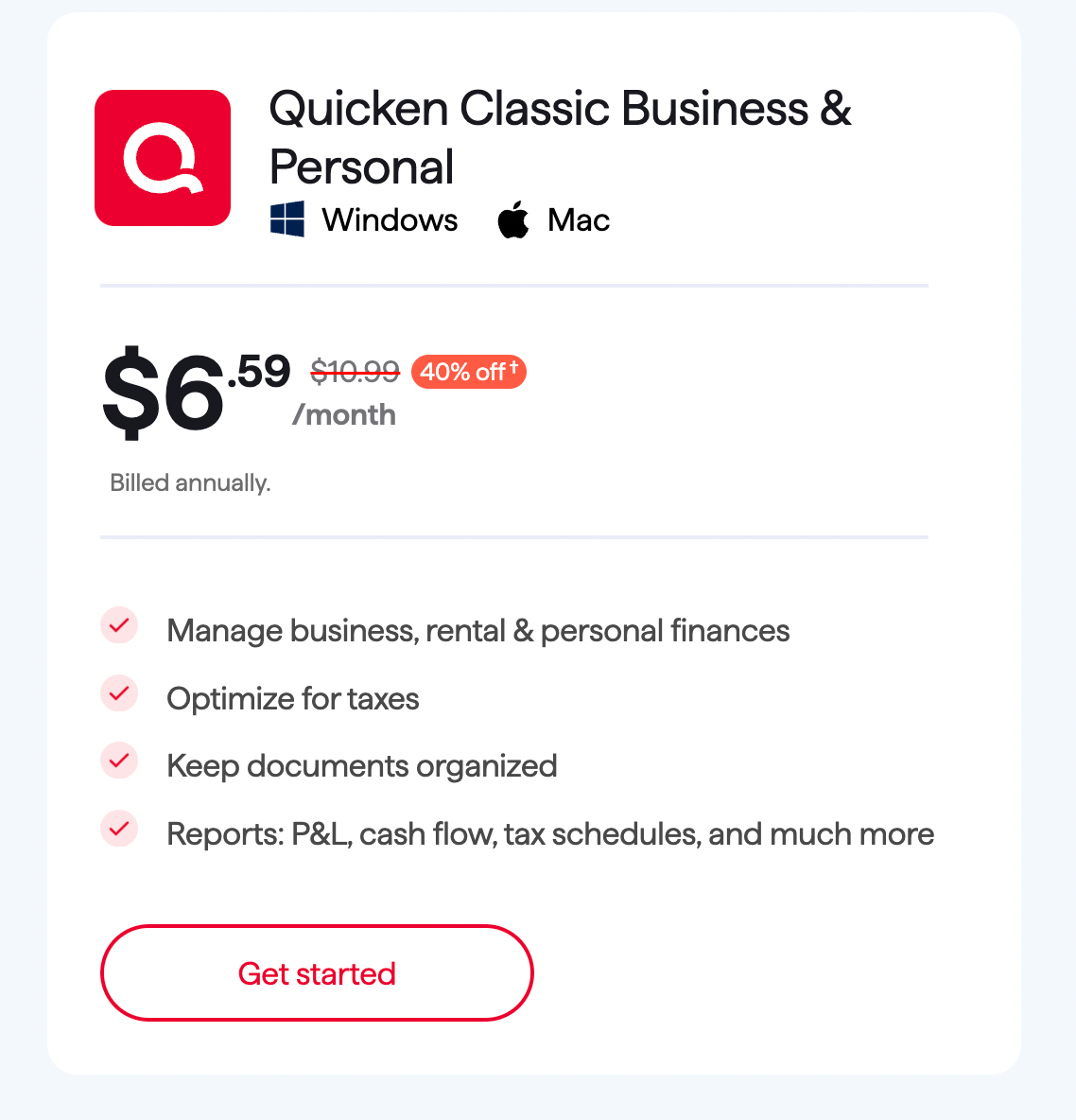

5. Quicken

Quicken is a great church accounting software that allows you to manage every budget, track payables, receivables, vendors, customers, and more. Along with this you can see your complete net worth in one place. Maximize tax deductions across both business & personal finances. Save time with built-in reports for tax Schedules A through E, and export your data to TurboTax for tax season.

Customize any report to show you any combination of accounts you want to see. Deep dive into your cash flows, profit & loss, investments, debt, asset accounts, and more.

Create customized templates with your company’s logo, colors, and messaging, and send invoices with a click. Get paid faster with PayPal payment links — included automatically.

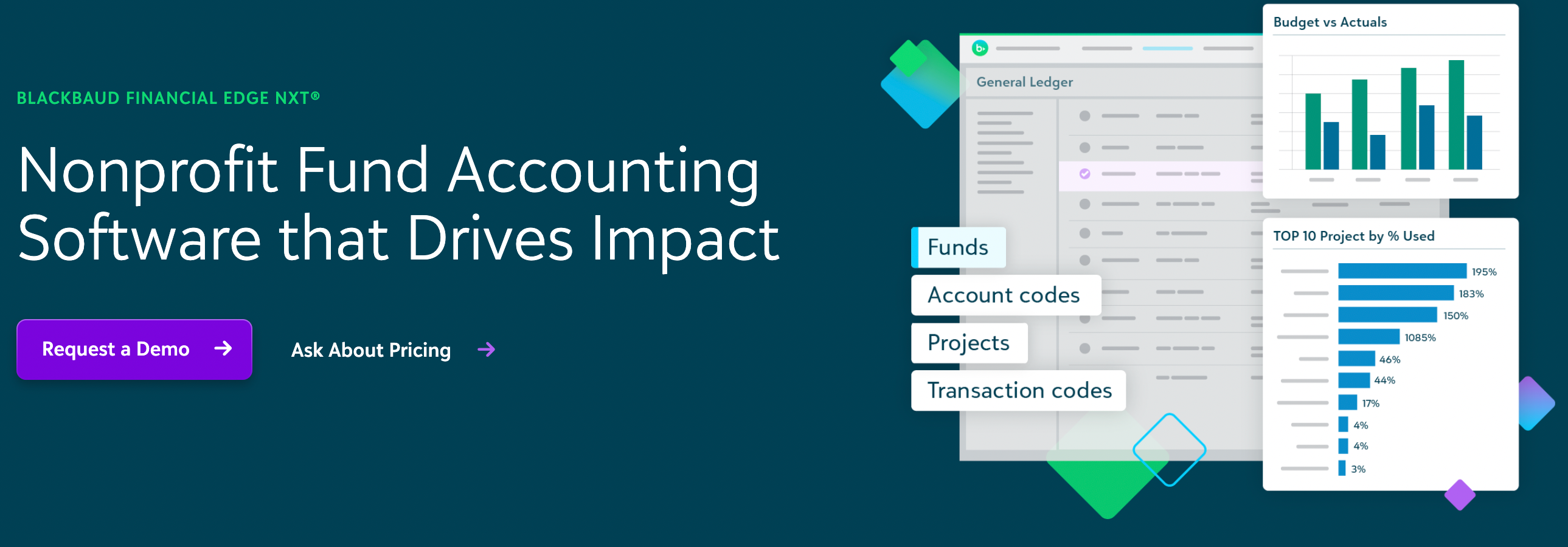

6. Blackbaud Financial Edge NXT

First 6 months free for new customers!

Blackbaud Financial Edge NXT is designed specifically for nonprofit fund accounting. You’ll save a lot of time with software built how you need it, including intuitive workflows and automated routine tasks.

- Enjoy purpose-built fund accounting designed for your needs, not the confusing workarounds competitors require for the complexity of nonprofit financial management.

- Automated Bank and Credit Card reconciliation speeds time to close and reduces multiple errors.

- Automated budget and report creation reduces time spent compiling, distributing, and consolidating reports and budget worksheets.

- Patented expense submission with automated routing rules and budget checking.

- View-only licenses reduces time spent responding to ad hoc reporting requests.

Blackbaud’s cloud fund accounting software Blackbaud Financial Edge NXT provides transparency across teams, security, and compliance, and reduces the need for manual processes. The fund accounting software provides a general ledger, projects, grants, accounts payable and receivable, fixed assets, banking, and more. With a personalized dashboard and customizable views, Blackbaud Financial Edge NXT enables users to monitor income statements, program-to-expense ratios, cash balances, and other key metrics.

Blackbaud Financial Edge NXT offers real-time reporting, with one-click drill-down functionality and export capability, to enable data-driven decisions. The system allows users access to grant and project accounting that allows for streamlined management of budget, as well as a way to effectively monitor accounts and generate reports.

By using Blackbaud Financial Edge NXT, tax-exempt organizations can reduce dependency on manual processes, improving data entry accuracy and efficiency. Blackbaud Financial Edge NXT is backed by a company with four decades of experience in the social good space, serving nonprofits, foundations, corporations, and healthcare and education institutions.

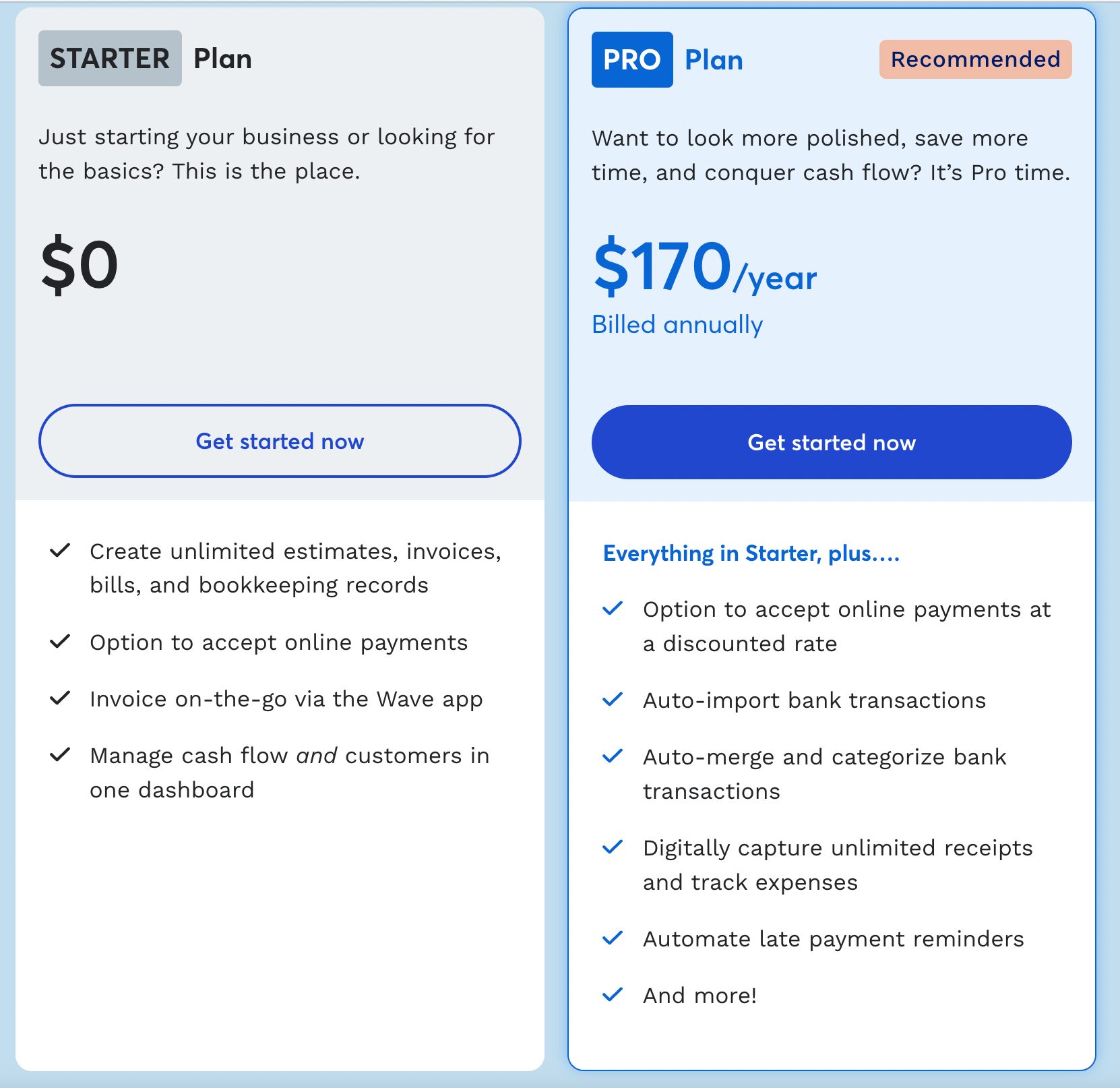

7. Wave Accounting

They are an online church accounting software that provides features including invoicing, billing, payment tracking, payroll management, finance management, credit card processing, and receipt scanning. Wave Accounting is designed to help businesses streamline bookkeeping processes. With Wave’s bank reconciliation tools, your church can manage all bank account and credit card information in real-time to improve bookkeeping efficiency and accuracy.

Businesses can also generate reports that include various data such as sales tax, balance sheet, cash flow, and profit/loss. Wave’s dashboard includes an invoicing tool that collects invoice payments. A small business owner can choose customizable invoicing templates based on unique business needs. Invoices can be sent via email and the software’s credit card processing feature allows users to collect payments on the internet Recurring invoices and automatic payment features are available for regular customers.

With the Pro Plan, automatically import, merge, and categorize your bank transactions. Access your data anywhere at any time. It’s always available, and it’s backed up for extra peace of mind. Connect your bank accounts in seconds with the Pro Plan. Transactions will appear in your bookkeeping automatically, and you’ll say goodbye to manual receipt entry.

Keep an eye on the big picture so you can make better business decisions. Our robust small business accounting reports are easy to use and show month-to-month or year-to-year comparisons so you can easily identify cash flow trends.

8. Churchtrac

ChurchTrac is a great online church management software for churches of all sizes. The software allows church administrators to reconcile bank statements and stay in sync with their banks by matching actual transactions with the bank statements. This feature helps them prevent accounting errors, keep track of the church’s finances, understand mismanaged funds, and generate accurate reports to ensure financial transparency.

Product features of interest:

- Budget creation: Categorize your expenses and donations to create yearly budgets and evaluate the amount spent or received against the budget. You can do either a brief setup or a detailed setup for each budget item

- Transaction search: Locate accounting transactions using filters, such as date, payee name, amount, tag, and category. The feature can help you track expenses for a particular category or fund and find uploaded documents related to a transaction

- Accounting reports: Generate income statements, balance sheets, fund statements, and other church accounting reports. You can save these reports as a PDF and print them for future reference

Out of all the accounting programs for churches, ChurchTrac is the most affordable. They also have a great feature on their website that allows you to choose how many individual names you need to enter. The pricing will adjust based on how large of an account you need.

Other Accounting Features

- Print to several styles of check, with customizations for your specific check layout.

- Set up repeating or recurring transactions for quick entry.

- Use our powerful search tool to locate transactions that meet your criteria.

- Accounting works seamlessly with ChurchTrac Giving, making deposits simple and easy to track.

- Generate income statements, balance sheets, fund statements, and many other Church accounting reports.

- Make sure you stay in sync with your bank by matching transactions up to your bank statements.

9. Realm

Realm is another amazing and helpful church accounting software that assists pastors and administrators in church administration, accounting, and community management. The platform offers payroll runs that automatically process employee salaries’ disbursement by calculating necessary withholdings and processing adjustments, such as employee benefits and additional compensation. It also helps you maintain important details about your employees, such as their profiles and family data, and accommodate special tax requirements and allowances for ministerial members.

Product features of interest:

- Time entry: Create employee timesheets to manage their schedules and calculate payroll for specific working days. You can also split employees into groups to process their payments and calculate their compensation for particular jobs

- Tax filing: Generate, review, and electronically file tax forms, such as 1099s and W-2s, by considering federal, state, and local taxes. The software also offers payroll tax liability reports to get an overview of your organization’s tax obligations

- Reporting: Generate, customize, and share accounting reports with others. The software also offers a report history feature that lets you download a recent report you may have lost

Start a free trial with realm today!

Related Links: